LTC Price Prediction: Is $150 the Next Stop as Bulls Take Control?

#LTC

- Technical Breakout: LTC price clears 20-day MA with Bollinger Band expansion signaling momentum

- Institutional Catalyst: $50M crypto allocation and ETF rumors amplify bullish sentiment

- Macro Alignment: Rising adoption as payment rail complements technical upside

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

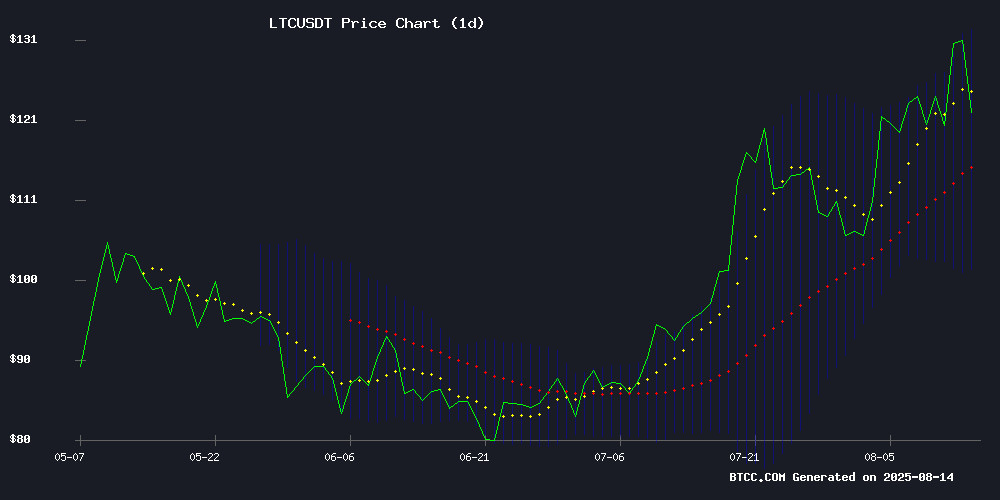

Litecoin (LTC) is currently trading at, comfortably above its 20-day moving average (MA) of, signaling a bullish near-term trend. The MACD histogram remains negative (-2.4551) but shows narrowing bearish momentum as the fast line (-6.9294) converges toward the slow line (-4.4743). Bollinger Bands indicate moderate volatility with price hovering NEAR the upper band (), suggesting potential resistance ahead.says BTCC analyst John.

LTC Price Rally Fueled by ETF Speculation and Payment Adoption

Litecoin’spast $132 aligns with bullish headlines, including ETF speculation and Thumzup Media’s $50M crypto allocation.notes BTCC’s John. Technicals support this optimism—the price breakout above the 20-day MA coincides with Bollinger Band expansion, typically preceding volatility spikes.

Factors Influencing LTC’s Price

Top 3 Altcoins to Watch as Market Sentiment Shifts

Ethereum (ETH), Binance Coin (BNB), and Chainlink (LINK) are leading the altcoin rally as Bitcoin's dominance dips below 60%. Investor interest has surged, with search volumes for altcoins hitting historic highs—eclipsing even the peaks of the last bull cycle.

Market dynamics suggest a liquidity rotation into altcoins, with Ethereum breaching $4,500. Key metrics like trading volume, network utility, and dominance shifts are critical for identifying winners. Honorable mentions include Hype (HYPE), Ripple (XRP), and Litecoin (LTC), though selectivity remains paramount in a crowded field.

Dominance trends reveal sentiment shifts: Bitcoin gains during risk-off phases, while altcoins thrive in bullish conditions. Volume spikes often precede liquidity inflows, making these indicators essential for timing entries.

Thumzup Media Allocates $50M to Bitcoin and XRP in Strategic Crypto Expansion

Bitcoin surged to a record high above $124,000 amid optimism over potential U.S. interest rate cuts, regulatory tailwinds, and institutional demand. The Crypto Fear & Greed Index hit 75 (Greed), reflecting bullish sentiment as BTC gained 7% weekly and altcoins followed.

Nasdaq-listed Thumzup Media capitalized on the momentum, securing $50 million through a secondary share offering at $10 per share. The company plans to deploy 90% of liquid assets into crypto holdings and mining infrastructure, targeting $250 million in total exposure. CEO Robert Steele emphasized building "durable, revenue-generating assets" through this aggressive treasury strategy.

Thumzup's portfolio will include Bitcoin, Ethereum, Solana, Litecoin, Dogecoin, and newly added XRP, with partial allocations to stablecoins. The move signals growing corporate adoption of digital assets as both operational reserves and long-term investments.

Litecoin Breaks $132 as LTC Price Surges on ETF Hopes and Payment Adoption

Litecoin has surged past $132, marking a significant milestone as institutional interest and payment adoption fuel its upward trajectory. The cryptocurrency now trades at $132.62, up 1.45% in the past 24 hours, with its Relative Strength Index (RSI) hitting 70.60—a signal of overbought conditions that may foreshadow near-term resistance.

The breakout follows a three-year consolidation period, shattered on August 5th with a single-day rally of 10.85%. Fundamental support comes from Litecoin's growing utility: it ranks as the second most-used cryptocurrency for payments on CoinGate, capturing 14.5% of the platform's transaction volume. Meanwhile, speculation around a potential ETF approval has intensified, with analysts pricing in a 95% probability by 2025.

Litecoin (LTC) Price Prediction – Is Litecoin Setting Up For a Massive Breakout?

Litecoin, one of the earliest Bitcoin spin-offs, is showing signs of a potential breakout. The network's transaction volume, while half that of Bitcoin's, demonstrates active blockchain usage. Miner sell-offs and growing network activity historically precede price rallies, yet LTC has traded sideways for years.

Technical analysis reveals a coiled price structure. With faster transaction times and a distinct mining algorithm, Litecoin's fundamentals diverge from its subdued market cap. The 2024 metrics suggest undervaluation relative to network growth.

How High Will LTC Price Go?

LTC could target $150 if it sustains above the 20-day MA (117.33 USDT), with these key levels to watch:

| Level | Price (USDT) | Significance |

|---|---|---|

| Resistance 1 | 133.17 | Upper Bollinger Band |

| Support 1 | 117.33 | 20-day MA |

| Support 2 | 101.49 | Lower Bollinger Band |

BTCC’s John highlights: "ETF hype and MACD reversal could propel LTC toward 2025 highs, but a close below 117.33 would invalidate the bullish case."